Understanding Interchange Rates

Interchange rates—sometimes called “swipe fees”—are a core part of accepting credit and debit card payments. They’re set by the card networks (like Visa and Mastercard) and are paid between banks every time a card is used. For your business, understanding how these fees work can help you make smarter decisions and better manage your payment costs.

What Are Interchange Rates?

Interchange rates are transaction fees that your payment processor pays to the customer’s bank every time you accept a card payment. These fees help cover the costs and risks banks take on by issuing cards and handling transactions. Card networks set these rates, and they’re usually a percentage of the sale plus a small fixed fee.

How Do Interchange Fees Work?

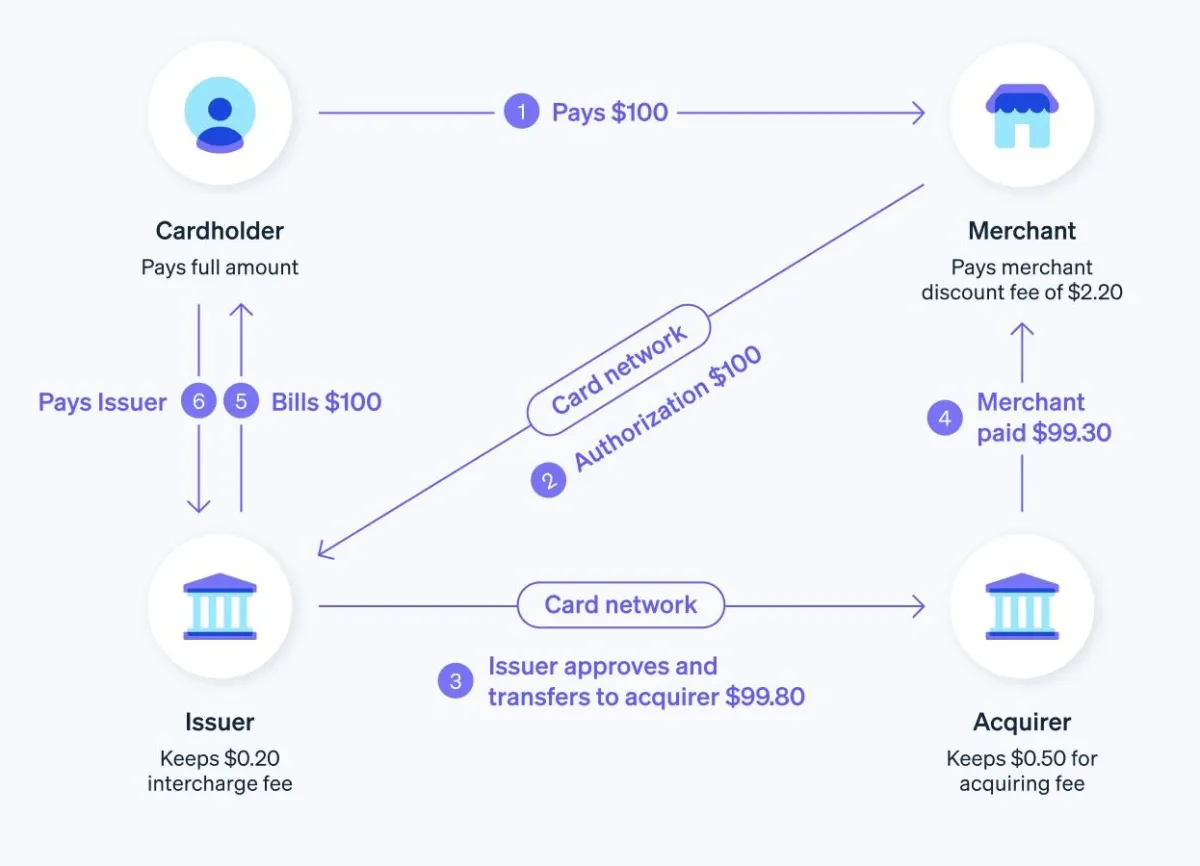

Every card transaction follows this basic flow:

Transaction Initiation: Your POS or online gateway sends the sale details to your acquiring bank.

Authorization: The acquiring bank sends the info to the card network (Visa, Mastercard, etc.), which routes it to the cardholder’s bank.

Approval: The issuing bank checks the customer’s account and sends an approval or decline back through the network.

Settlement: At the end of the day, approved transactions are settled—funds move from the cardholder’s bank to your bank, minus the interchange fee.

Payment to the Business: The card network transfers the total amount of the batch to the acquiring bank minus interchange fees. The acquiring bank then deposits the funds into your business account, minus its own fees.

What Influences

Interchange Fees?

Interchange rates aren’t fixed—they vary based on several factors:

Card Type: Rewards, business, and premium cards have higher fees than basic debit cards.

Transaction Method: In-person (chip, tap, swipe) is usually cheaper than online or keyed-in sales.

Business Type: Some industries (like nonprofits) may qualify for lower rates.

Transaction Size: Larger transactions may have lower percentage fees but higher fixed fees.

Processing Details: Manual entry or delayed settlement can increase the fee due to higher risk.

How Do Interchange Fees Affect Your Business?

They make up a significant part of your card processing costs.

Interchange fees are deducted before funds hit your account, so they impact your cash flow.

They can influence your pricing strategies and the types of payments you accept.

Ready to get started?

Let’s make payments simple—together.

Reach out for a friendly, no-pressure conversation about your business needs.

We’re here to answer your questions, review your current setup,

and help you find the best solution—no hidden fees, no surprises.

Contact us today and experience the difference of real, local support.

© 2026. Electronic Payments Northeast. All rights reserved.

Electronic Payments is a registered ISO/MSP of Commercial Bank of California

Electronic Payments is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, CA.

Electronic Payments is a registered MasterCard© TPP

American Express may require separate approval