Compliance Processing & Card Processing Price Plans

Choosing the right pricing model for card processing is essential for transparency, savings, and compliance. Here’s a breakdown of the most common options and what you need to know about passing fees to customers.

Pricing Models

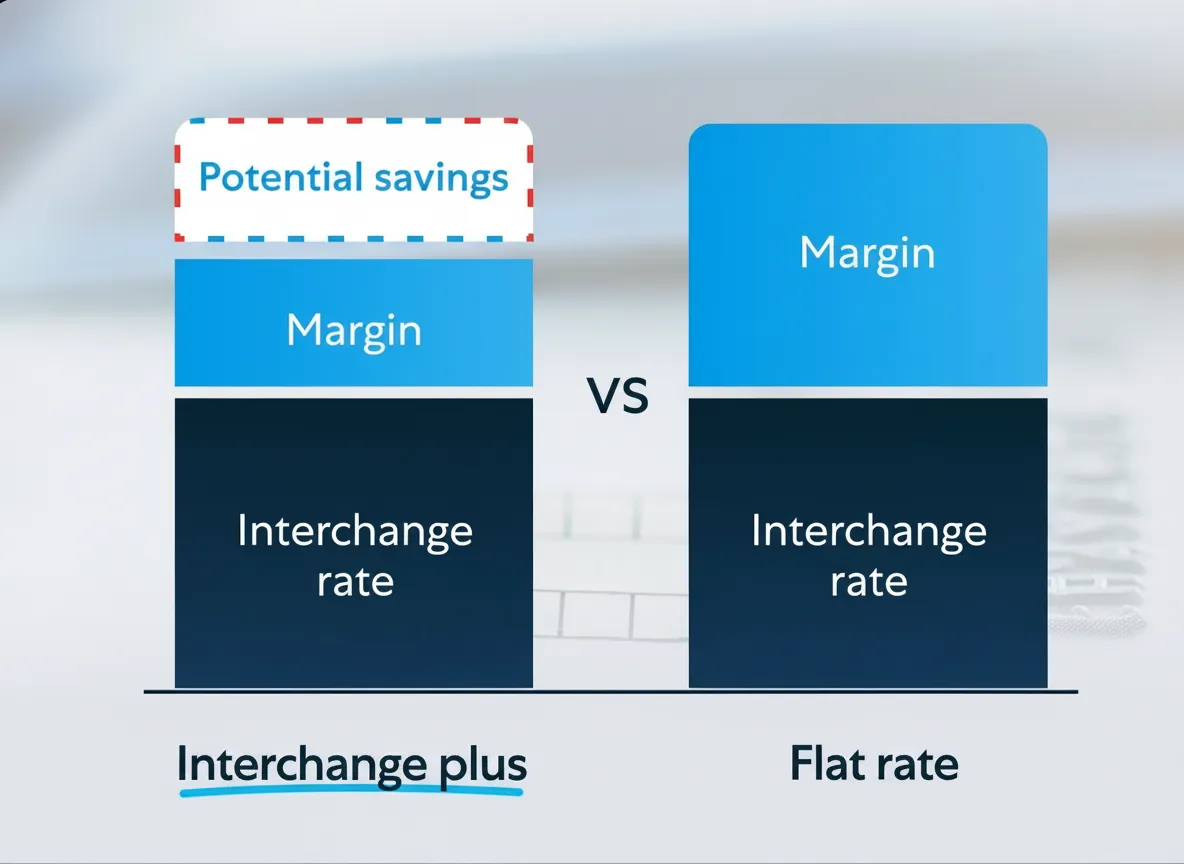

Interchange Plus

With Interchange Plus, you pay the actual interchange rate (set by the card networks) plus a transparent, fixed markup from your processor. Each transaction is itemized, so you see exactly what you’re paying and why. This model is often the most cost-effective and fair, especially as your business grows or if you process a variety of card types.

Pros: Transparent, itemized fees; cost savings for larger or growing businesses

Cons: Variable monthly costs; more detailed statements

Best For: Businesses that want full transparency, have higher volumes, or want to optimize costs as they grow

VS

Flat Rate

Flat Rate pricing means you pay a fixed percentage (and sometimes a flat fee) for every transaction, regardless of the card type or how it’s processed. This model is simple and predictable—great for budgeting and businesses with lower volumes or straightforward needs. However, the simplicity often comes with a higher overall cost, since the processor builds in a larger margin to cover all scenarios.

Pros: Simple, predictable pricing; easy to understand

Cons: Can be more expensive for higher-volume or larger-ticket businesses

Best For: Small businesses, startups, or anyone who values simplicity over granular cost savings

Why Interchange Plus Over Flat Rate?

Interchange Plus pricing gives you direct visibility into the true cost of each transaction. You only pay the actual interchange plus a small markup, so you’re not overpaying for low-cost transactions. Flat rate is simple, but often includes a higher margin for the processor and less flexibility as your business grows. If you want to maximize savings and transparency, Interchange Plus is usually the better long-term choice.

Passing Fees Off: Compliance Pricing Options

Cash Discount

A cash discount program lets you offer a lower price to customers who pay with cash. Instead of adding fees for card payments, you simply discount the total for cash-paying customers at checkout. This approach is simple, compliant, and easy for customers to understand.

Approved Signage:

"We offer a [RATE]% discount to customers paying with cash."

Considerations:

Display one price (the list price).

Apply discount at checkout if paid in cash.

Do not add fees to receipts or final price for non-cash tenders.

Dual Pricing

Dual pricing means every item displays both a card price and a cash price, giving customers a clear choice at checkout. Customers paying with cash receive the lower price, while those using cards pay the listed card price. It’s a transparent, compliant way to manage payment costs without adding fees at the register.

Approved Signage:

"All items have two prices, a List price and a Cash price. Customers are billed based on how they choose to pay.savings"

Considerations:

Display All items must reflect both prices on tags, menus, or labels.

Cash = Cash Price; All other tenders = List Price.

Do not add fees to receipts or final price.

Surcharging

Charge a fee on credit card payments (not debit cards) to offset processing costs.

Approved Signage:

“We impose a surcharge of [RATE]% on the total transaction amount on credit card products, which is not greater than our cost of acceptance. We do not surcharge debit cards.”

Considerations:

Be in a state that legally supports surcharging.

Utilize equipment that supports surcharging.

Do not surcharge PIN Debit, Pre-Paid Debit, or

Signature Debit cards.

Cap the surcharge at 3%.

Ready to get started?

Let’s make payments simple—together.

Reach out for a friendly, no-pressure conversation about your business needs.

We’re here to answer your questions, review your current setup,

and help you find the best solution—no hidden fees, no surprises.

Contact us today and experience the difference of real, local support.

© 2026. Electronic Payments Northeast. All rights reserved.

Electronic Payments is a registered ISO/MSP of Commercial Bank of California

Electronic Payments is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, CA.

Electronic Payments is a registered MasterCard© TPP

American Express may require separate approval